Online Gambling Stocks 2020

Top Online Casino Stocks To Watch For Q4 2020: DraftKings Shares of DraftKings (DKNG Stock Report) have jumped more than 45% in the past month. This came after the company announced a deal with. The 3 Largest Gambling Stocks in 2020 Two iconic casino operators are suffering due to COVID-19 headwinds, but the third is thriving from the online sports betting boom. Q2 2020 hedge fund letters, conferences and more. However, what if we combine the two, and look into investing in gambling stocks? It’s a surging industry. Estimates say that the global gambling market will hit a value of around $565 billion, growing at a rate of 5.9% per year through 2022.

While everyone is looking to the renowned stocks that have been in the exchange market for decades, some investors are shifting their focus on the online iGaming industry.

Most of us have by now tried betting on sports or playing online casino games. Recently, this is one of the industries that have been escalating at an alarming rate across the globe.

Besides the level of new gaming technology like mobile casinos, and live dealers giving this industry much support for visibility, the introduction and legalization of gambling in most countries have also contributed to its growth. But have you ever thought of investing in this industry as an investor?

Well, it is quite easy, and online casino is a fast-growing market as more and more countries legalize iGaming on the internet. From Canada, Sweden, China, the US, to the UK, the stocks might turn out to be a good investment. Here are ten iGaming stocks that everyone can invest in (this being intended exclusively for information purposes):

1. Ladbrokes – GP.22

This is another gambling stock that you can invest in that is on the London Stock Exchange. It is a benchmark in the United Kingdom when it comes to online betting. It is one of the most solid companies across the globe in this industry that has made its stocks very stable. After a close analysis of its 10 years in the stock market, experts call it a conservative investment.

2. NetEnt – NETB

This is another high-quality software provider in the virtual casino world. Every tester in Canada, usually go to this company as a quality seal. Although this company joined the gambling sector a little bit late compared to the others, it has been at the forefront when it comes to online casinos and popular slots. Its stocks in the Stockholm Stock Exchange has been doing well after overcoming stiff competition from the other companies in the market.

3. Stars Group – TSGI

Have you ever heard of PokerStars? This is the head and the hub of some of the largest poker sites across the globe. On the internet, it is one of the best gambling companies when it comes to its coverage. With its expertise in the field, it has positioned itself as one of the leading and key players in this industry. But, its stock and shares in the market have been volatile. It is on the Toronto Stock Exchange and it is good for the professional traders.

4. LeoVegas – LEO.ST

Over the past five years, this has been one of the most successful gambling company in Sweden. One of the things that giving LeoVegas a footing in online gambling is its smartphone casinos with the most popular one being Leo Vegas Casino. It has been making it possible for gambling fanatics to play their favorite online slots using their mobile phones. It is on the Nasdaq Stock Exchange.

5. Kindred Group – KIND-SDB

These stocks and shares from the Kindred Group are on the Stockholm Stock Exchange. It is one of the great companies with various betting sites revolving around sports, online casinos, bingos, and poker. Unibet happens to be the trademark of the Kindred Group which so is the largest betting site in sports globally.

6. Caesars Entertainment Corporation – CZR

For many years, this has been a landmark in the gambling industry. It has recently turned out to be one of the most interesting stocks to put your money. It is one of the leaders in the gambling industry that most investors are watching and aspiring to invest in.

7. MGM Resorts International – MGM

If you are a conservative investor and don’t want risks around you, then you can decide to go with MGM. It is trying to get to US betting which will definitely spearhead its stocks and entire market share. It is one of the gambling stocks that has a great presence in China and has been doing well from one year to another.

8. Scientific Games – SGMS

It is one of the stocks that have gained online dominance and beat stiff competition around online casino gaming. It has been a significant company in providing digital gaming services, content, and products. As an infrastructure provider, it has all the chances of growth in this market making it a good stock to watch.

9. International Game Technology – IGT

This is another innovative casino gaming company that is increasing and expanding its digital gaming expertise across the globe. Its live streaming avenue of Dynasty Electronic Table Game (ETG) will provide more games for its players like blackjack and the famous baccarat. With such kind of innovations, definitely, its stock will grow to make it a great gambling stock to put your money in.

10. Playtech – PTEC

This Israel based software developer is one of the popular casino software providers across England. It has its stock listed on the London Stock Exchange. Playtech is an expert in online casino gaming has released over 500 games. It uses some of the most advanced technology in virtual casinos. Considering the vast and fast growth of the gambling industry, if you are an active investor, then you can consider one of the above gambling stocks.

DISCLAIMER:

News, data and statement included in this article is intended exclusively for information purposes.

It should not be considered a recommendation for the purchase, retention, or sale of the securities referred to herein.

Contents

Sports betting and esports betting is a growing industry. With the coronavirus crisis continuing sports betting will experience a likely temporary stall but this gap will be fuelled by the growth in esports and esports betting.

Online Gambling Stocks 2020

Gambling operators who offer sports and esports betting will concentrate on their esports and online gaming offerings, potentially overcoming a blip in their revenue generation with spending and gambling on gaming. Indeed, esports and gaming is an industry that is thriving as people stay home in 2020. Verizon is reporting increases in online gaming activity of up to 75%. Esports betting sites like Unikrn and Luckbox are reporting unprecedented growth in esports betting activity. Luckbox, for example, saw betting revenue rise by 50% in February and March of 2020.

Coupled with demand and growth, gambling operators are finding new market opportunities and affirmation of their activities in the form of regulatory approvals for sports and esports betting. Nevada’s gambling regulators have now approved betting on Call of Duty, CS:GO, League of Legends, Dota 2, iRacing, and Overwatch including online-only events and tournaments perfectly acceptable in a time of physical distancing.

The US lifted a federal ban on sports betting in 2018. Many US states have now legalized sports betting and esports betting is increasingly positively regulated. As per US News around $13 billion worth of sports bets were placed in 2019. The Bank of America predicts that sports betting could be available to 50% of citizens by 2022, with 30% having access to mobile gaming. In addition, sports gambling could grow at as much as 32% CAGR in the next three years. As per Wholesale Investor and Luckbox, Esports betting is forecast to grow at a rate of 44% CAGR over a four-year period reaching a value of $17.2 billion by the end of 2020.

The long-term growth potential of sports and esports gambling and the short-term significant spike in esports betting coupled with a longer-term rise provides a viable opportunity for investors. Let us look at sports betting and esports gambling stocks worth watching and considering right now:

1. Caesars Entertainment Corporation

Pitched as one of the most geographically diverse US casino entertainment companies, by September 2019 Caesars was running sports betting in seven US states. As of April 23, 2020, the company’s stocks had achieved over 6% gains in the five prior trading sessions leading to bullish predictions for its shares. As per News Heater, in addition, Barron’s is reporting an online gambling boom amidst the coronavirus lockdown.

The value of Caesars stock has been steadily rising across April, from a price of $6.28 per share on April 3 to $8.87 on April 24. Many analysts predict the casino company’s share price to rise above $10 and some, like Credit Suisse give “outperform” ratings for Caesars and a target share price as high as $13.

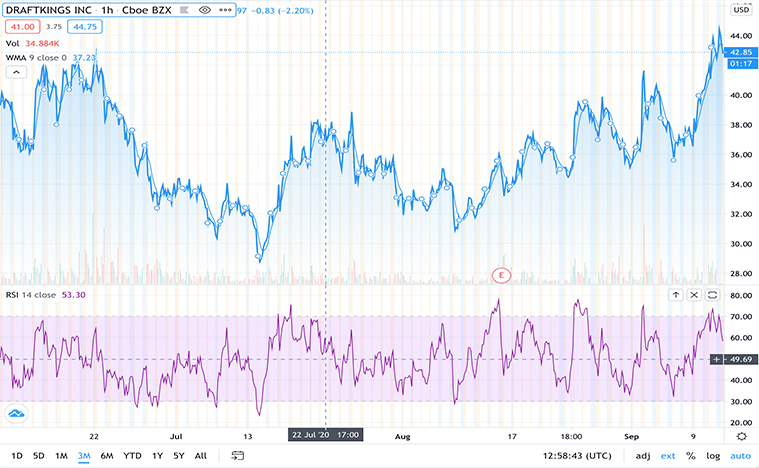

2. DraftKings

Online Gambling Stocks 2020 Date

Sports betting company DraftKings has just become publicly listed after its merger with Diamond Eagle Acquisition Corp and SBTech. Its first day of trading on April 24 saw stock price surges as high as 18% with its stock price settling at $19.35 at the close of trading, as per Market Watch.

DraftKings CEO Jason Robins expects sports betting demand to rebound after the coronavirus crisis. Despite a shortage of sports betting opportunities, DraftKings is offering new gambling opportunities. Its fantasy esports contests saw 50-fold growth in March and its allowing users to bet on simulated matches in games like Madden NFL, as per CNN Business.

DraftKings

3. Flutter Entertainment

Bookmaking holding company Flutter Entertainment was created out of the merger between Paddy Power and Betfair. Its stocks have been popular for some time, illustrated by a high price-to-earnings ratio for its shares. But, with the impact of the coronavirus it has canceled its 2020 stock dividend. It has furloughed staff too, but as per the Motley Fool is financing this without government help.

Flutter Entertainment also owns Sportsbet in Australia as well as the US’s FanDuel. It is due to merge shortly with the Canadian gambling giant The Stars Group (CSG). Across the first quarter of 2020, Flutter saw overall revenue up 16% to £547 million with sports betting up 13% to £407 million and gaming revenue up to £140 million.

Online Gambling Stocks 2020 Stock Market

4. LeoVegas AB

Sweden’s LeoVegas AB has seen a significant share price rise of over 20% in recent months. Some question whether the company is undervalued whilst other analysts argue this point. There is optimistic future growth but the stock price hike for LeoVegas may have already happened depleting the opportunity for new investors, as per Simply Wall St.

LeoVegas has a “Mobile First” strategy which could position it well for future growth as the global mobile gaming market grows. Its brands include Royal Panda, Pixel.bet, Bet UK, Crown Bingo, and Bingo Stars amongst others.

5. MGM Resorts International

Though MGM does have some reliance on the physical gambling mecca of Las Vegas and its casinos it did also see the opportunity of online betting early and could be a position to take advantage of a growing sports gambling market. Physical casino closures due to the coronavirus have impacted MGM and its stock price plummeted then recovered slightly, as per Motley Fool, as a result. MGM’s established brand and substantial financial resources mean that it could survive the current global crisis well and come out positively on the other side.

MGM partnered with GVC Holdings to develop its popular BetMGM mobile wagering application to take advantage of the increasing legalization of sports betting.

Morgan Stanley analyst Thomas Allen believes sports betting will be the biggest growth opportunity for the US gambling industry. Allen says legal sports betting revenue was less than $1 billion in 2019 but is expected to reach $7 billion by 2025. The illegal sports betting market is estimated at a size of around $150 billion.

If you’re unsure about investing in sports betting or esports betting stocks, take a look instead at some of the gaming and esports stocks worth watching in 2020.